All Categories

Featured

Table of Contents

The are whole life insurance and global life insurance coverage. The cash money value is not included to the fatality benefit.

The policy loan passion rate is 6%. Going this route, the rate of interest he pays goes back right into his plan's money worth rather of a financial institution.

Infinite Banker

Nash was a financing expert and follower of the Austrian school of business economics, which promotes that the value of goods aren't clearly the result of conventional financial structures like supply and demand. Instead, people value cash and items differently based on their economic status and demands.

Among the challenges of typical financial, according to Nash, was high-interest rates on finances. A lot of individuals, himself consisted of, entered economic trouble as a result of reliance on banking institutions. So long as banks set the rate of interest and lending terms, people didn't have control over their own wealth. Becoming your own banker, Nash determined, would place you in control over your financial future.

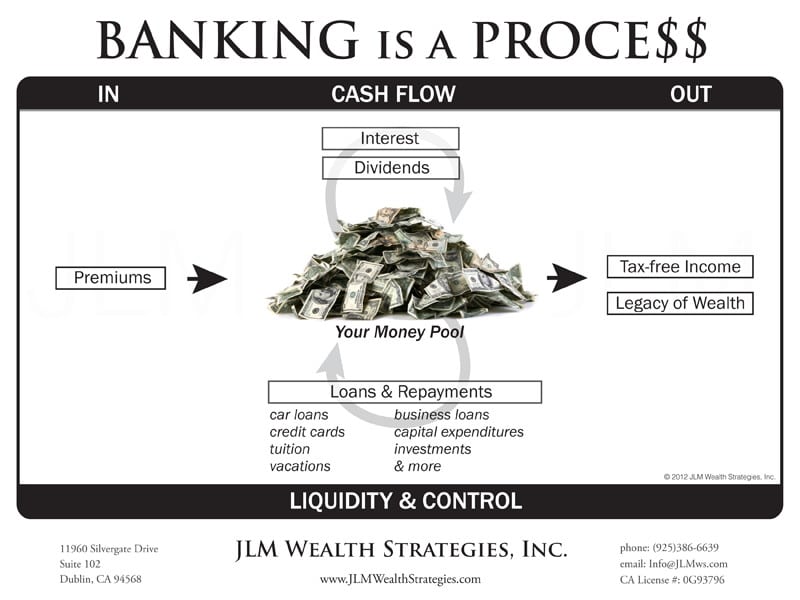

Infinite Financial needs you to possess your economic future. For ambitious individuals, it can be the very best financial device ever. Here are the benefits of Infinite Banking: Perhaps the single most helpful aspect of Infinite Financial is that it improves your cash circulation. You do not require to experience the hoops of a traditional financial institution to obtain a financing; just request a policy finance from your life insurance coverage firm and funds will be made available to you.

Dividend-paying entire life insurance is extremely reduced threat and offers you, the insurance holder, a terrific offer of control. The control that Infinite Banking uses can best be organized right into 2 groups: tax advantages and possession protections.

Infinite Banking System

When you make use of whole life insurance policy for Infinite Banking, you participate in an exclusive agreement in between you and your insurer. This personal privacy supplies certain asset securities not found in various other financial vehicles. Although these securities may vary from state to state, they can include defense from possession searches and seizures, protection from reasonings and security from creditors.

Whole life insurance coverage policies are non-correlated assets. This is why they work so well as the economic structure of Infinite Banking. Regardless of what happens in the market (supply, property, or otherwise), your insurance coverage preserves its worth. Also several individuals are missing out on this important volatility barrier that aids secure and expand wealth, instead splitting their cash right into 2 pails: bank accounts and financial investments.

Market-based investments expand wealth much quicker yet are revealed to market changes, making them inherently dangerous. What happens if there were a 3rd bucket that used safety but also moderate, surefire returns? Entire life insurance coverage is that 3rd container. Not only is the price of return on your entire life insurance policy plan assured, your fatality advantage and costs are also ensured.

Below are its major benefits: Liquidity and accessibility: Plan fundings offer immediate accessibility to funds without the limitations of typical financial institution financings. Tax effectiveness: The cash value grows tax-deferred, and policy fundings are tax-free, making it a tax-efficient tool for constructing wide range.

Bioshock Infinite Vox Cipher Bank

Asset defense: In several states, the cash worth of life insurance is protected from financial institutions, adding an additional layer of economic security. While Infinite Financial has its merits, it isn't a one-size-fits-all remedy, and it features considerable downsides. Right here's why it might not be the very best method: Infinite Financial typically calls for intricate plan structuring, which can perplex insurance policy holders.

Picture never ever having to fret regarding bank lendings or high rate of interest rates again. That's the power of limitless financial life insurance coverage.

There's no set funding term, and you have the liberty to pick the settlement timetable, which can be as leisurely as paying off the lending at the time of death. This versatility encompasses the servicing of the financings, where you can select interest-only settlements, keeping the funding balance level and manageable.

Holding money in an IUL taken care of account being credited interest can usually be much better than holding the cash money on down payment at a bank.: You have actually constantly imagined opening your very own bakeshop. You can obtain from your IUL policy to cover the first costs of renting a room, purchasing equipment, and working with team.

Banking Life Insurance

Individual loans can be acquired from traditional financial institutions and cooperative credit union. Below are some bottom lines to think about. Credit scores cards can offer a flexible means to borrow money for extremely temporary durations. Nevertheless, obtaining cash on a bank card is generally very costly with annual percent rates of rate of interest (APR) commonly getting to 20% to 30% or more a year.

The tax obligation therapy of plan loans can vary substantially relying on your country of residence and the specific regards to your IUL plan. In some areas, such as North America, the United Arab Emirates, and Saudi Arabia, policy financings are generally tax-free, providing a significant benefit. In other jurisdictions, there might be tax ramifications to take into consideration, such as potential tax obligations on the financing.

Term life insurance coverage only offers a survivor benefit, without any money worth buildup. This means there's no cash money value to borrow against. This post is authored by Carlton Crabbe, Ceo of Capital forever, an expert in giving indexed global life insurance accounts. The information given in this article is for instructional and informative functions only and ought to not be interpreted as monetary or financial investment recommendations.

For loan policemans, the extensive guidelines enforced by the CFPB can be seen as cumbersome and limiting. Funding policemans commonly say that the CFPB's guidelines produce unneeded red tape, leading to more documentation and slower funding handling. Regulations like the TILA-RESPA Integrated Disclosure (TRID) rule and the Ability-to-Repay (ATR) requirements, while targeted at securing consumers, can bring about delays in shutting offers and raised operational prices.

Latest Posts

Whole Life Concept Model

Becoming Your Own Banker

Infinite Banking Concept Nelson Nash